How To Upload Financial Statement For IA To Produce A Pitch Deck Page

Ever wondered how crucial it is to upload your financial statement for IA when creating a pitch deck? Well, let me tell you, it's like the secret sauce that makes or breaks your business presentation. Whether you're aiming to attract investors or secure funding, having a solid financial statement uploaded is the key to unlocking opportunities. Let’s dive into this game-changing process and discover why it matters so much.

Let’s be real here, starting a business is not just about having a great idea. It’s about proving that your idea can actually work in the real world. That’s where financial statements come into play. They are like your business’s report card, showing potential investors that you’ve got the numbers to back up your vision. Uploading them correctly is essential if you want to produce a pitch deck that stands out.

Now, I know what you might be thinking—“Do I really need to bother with all this financial jargon?” Trust me, you do. Investors aren’t just throwing money at ideas they think are cool. They want to see the hard data, the cold, hard facts that prove your business is worth their investment. So, buckle up because we’re about to break down everything you need to know about uploading financial statements for IA to produce a killer pitch deck page.

Read also:Creative Soulmate Wedding Ring Tattoos A Beautiful Blend Of Love And Ink

Why Uploading Financial Statements is Essential

Understanding the Importance of Financial Statements

First things first, let’s get one thing straight—financial statements aren’t just random numbers on a page. They’re a detailed breakdown of your business’s financial health. When you upload these statements for IA, you’re giving them a clear picture of where your business stands. This includes your income statement, balance sheet, and cash flow statement. These documents show how much money you’re making, how much you owe, and how you’re managing your cash.

Investors love financial statements because they provide transparency. It’s like opening the hood of a car to see what’s really going on inside. By uploading these statements, you’re showing that you’re serious about your business and willing to be open about its financial state. It builds trust, and trust is everything when it comes to securing funding.

Steps to Upload Financial Statements for IA

Gathering the Necessary Documents

Before you even think about uploading, you need to make sure you have all the right documents. This includes your income statement, balance sheet, and cash flow statement. Don’t forget any supporting documents like tax returns or bank statements. Think of it like packing for a trip—make sure you’ve got everything you need before you leave the house.

Now, I know gathering all these documents might seem like a chore, but trust me, it’s worth it. Having everything organized and ready to go will save you a ton of time and hassle down the line. Plus, it’ll make the uploading process a whole lot smoother.

Choosing the Right Platform

Once you’ve got all your documents in order, it’s time to choose the right platform to upload them. There are plenty of options out there, from online portals to software programs. The key is to find one that’s user-friendly and secure. After all, you don’t want your sensitive financial information falling into the wrong hands.

Some popular platforms for uploading financial statements include QuickBooks, Xero, and FreshBooks. These platforms not only make it easy to upload your documents but also offer features like automated reporting and data analysis. It’s like having a personal assistant for your finances.

Read also:The Uglyest Person Alive Unveiling The Truth Behind The Label

Common Mistakes to Avoid

Incorrect Formatting

One of the biggest mistakes people make when uploading financial statements is using the wrong format. Make sure all your documents are in a compatible file type, like PDF or Excel. This ensures that the information is easily accessible and readable for IA.

Also, double-check that all your numbers are accurate and up-to-date. Nothing screams “amateur” like a financial statement filled with errors. Take the time to review everything carefully before hitting that upload button.

Missing Key Information

Another common mistake is leaving out important details. Your financial statements should include everything from revenue and expenses to assets and liabilities. Don’t assume that IA will know what’s missing—they won’t. Be thorough and include all the necessary information to give them a complete picture of your business.

Benefits of Uploading Financial Statements

Building Trust with Investors

As I mentioned earlier, transparency is key when it comes to attracting investors. By uploading your financial statements, you’re showing that you have nothing to hide. This builds trust and makes investors more likely to take a chance on your business.

Think of it like a first date. You want to make a good impression, right? By being open and honest about your financial situation, you’re setting the stage for a successful partnership with investors.

Streamlining the Investment Process

Uploading financial statements also makes the investment process smoother and more efficient. Instead of having to chase down documents or answer endless questions, everything is right there at your fingertips. This saves time for both you and the investors, allowing you to focus on what really matters—growing your business.

Best Practices for Uploading Financial Statements

Regularly Updating Your Documents

One of the best practices for uploading financial statements is to keep your documents up-to-date. This means regularly updating your income statement, balance sheet, and cash flow statement as your business grows and changes. It’s like giving your business a regular check-up to make sure everything is running smoothly.

Not only does this help you stay organized, but it also shows investors that you’re on top of your game. It’s a win-win situation for everyone involved.

Using Secure Platforms

Another best practice is to use secure platforms for uploading your financial statements. This ensures that your sensitive information is protected from cyber threats. Look for platforms that offer encryption and multi-factor authentication to keep your data safe.

Remember, security should always be a top priority. You don’t want to risk losing your financial information to hackers or other malicious actors. Play it safe and choose a platform you can trust.

Tips for Creating a Pitch Deck

Highlighting Key Financial Metrics

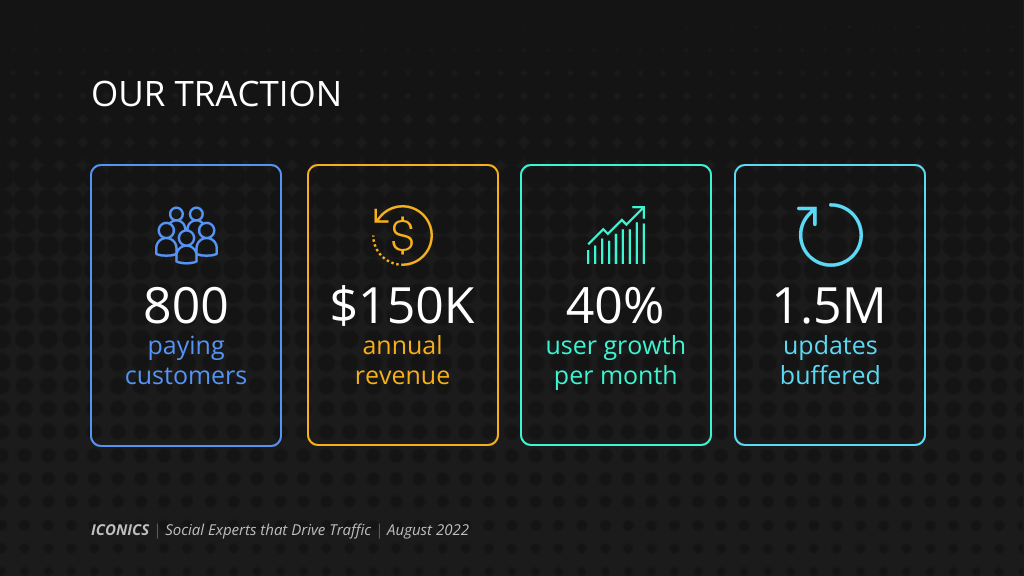

When it comes to creating a pitch deck, it’s all about highlighting the key financial metrics that matter most to investors. This includes things like revenue growth, profit margins, and return on investment. These metrics show investors that your business is not only viable but also profitable.

Use charts and graphs to make these metrics stand out. Visuals are a powerful tool for communicating complex information in a way that’s easy to understand. Just make sure they’re accurate and up-to-date.

Telling a Compelling Story

Don’t forget to tell a compelling story with your pitch deck. Investors want to know more than just the numbers—they want to know why your business is unique and why it’s worth their investment. Use your financial statements to paint a picture of your business’s potential and future growth.

Think of it like a movie trailer. You want to give investors a sneak peek of what’s to come and leave them wanting more. Be creative and think outside the box to make your pitch deck stand out from the rest.

Case Studies: Successful Businesses That Used Financial Statements

Example 1: Tech Startup

Let’s take a look at a tech startup that used financial statements to secure funding. This company uploaded their income statement, balance sheet, and cash flow statement to a secure platform and used the data to create a compelling pitch deck. They highlighted their revenue growth and profit margins, showing investors that their business was both viable and profitable.

The result? They secured millions in funding and went on to become a successful tech giant. It just goes to show how important it is to use financial statements to your advantage.

Example 2: E-commerce Business

Another great example is an e-commerce business that used financial statements to attract investors. They uploaded their documents to a user-friendly platform and used the data to create a pitch deck that told a compelling story. They highlighted their customer acquisition costs and return on investment, showing investors that their business was worth the investment.

Thanks to their efforts, they were able to secure the funding they needed to expand their business and reach new heights. It’s a testament to the power of using financial statements to secure funding.

Conclusion

Uploading financial statements for IA to produce a pitch deck page is a crucial step in securing funding for your business. By following the steps outlined in this article, you can ensure that your financial statements are accurate, up-to-date, and ready to impress potential investors.

Remember, transparency and security are key. Use secure platforms to upload your documents and make sure everything is in the right format. Highlight the key financial metrics that matter most to investors and tell a compelling story with your pitch deck. By doing so, you’ll be well on your way to securing the funding you need to grow your business.

So, what are you waiting for? Take action today and start uploading those financial statements. Your business’s future depends on it. And hey, if you’ve got any questions or need further guidance, feel free to leave a comment below or check out some of our other articles for more tips and tricks. Happy pitching!

Table of Contents

- Why Uploading Financial Statements is Essential

- Steps to Upload Financial Statements for IA

- Common Mistakes to Avoid

- Benefits of Uploading Financial Statements

- Best Practices for Uploading Financial Statements

- Tips for Creating a Pitch Deck

- Case Studies: Successful Businesses That Used Financial Statements

- Conclusion

Article Recommendations